Uncategorized

How to Choose Health Insurance: A Comprehensive Guide

Introduction

Choosing the right health insurance can be tough. There are many options. It is crucial to know the importance of health insurance. It helps you make informed decisions about your healthcare coverage. This article will help you choose health insurance. It will cover key factors to consider. You’ll find a plan that meets your needs and budget.

The Importance of Health Insurance

Financial Protection

A key reason to buy health insurance is to avoid high medical costs. Without insurance, a serious illness or accident can be costly. It can threaten your financial stability. A health insurance policy gives you peace of mind. You won’t face high out-of-pocket costs for necessary medical care.

Access to Quality Healthcare

Health insurance is vital for access to quality healthcare. With insurance, you are more likely to seek preventive care. It can help catch health issues early and improve your well-being. Also, insurance often covers many services. These include doctor visits, hospital stays, and prescription medications.

Key Factors to Consider When Choosing Health Insurance

1. Assess Your Healthcare Needs

Before diving into the details of different plans, take a moment to evaluate your healthcare needs. Consider factors such as:

-

Chronic Conditions: If you have ongoing health issues, get a plan that covers your treatments and medications.

-

Frequency of Doctor Visits: Estimate how often you visit doctors or specialists. Frequent visits may require a plan with lower copays or out-of-pocket maximums.

2. Understand the Types of Insurance Plans

Familiarize yourself with the various types of insurance plans available:

-

Health Maintenance Organization (HMO): Requires members to choose a primary care physician and get specialist referrals.. Typically offers lower premiums but less flexibility in choosing providers.

-

Preferred Provider Organization (PPO)It allows more choice in healthcare providers. No referrals are needed to see specialists.. Generally, this option comes with higher premiums.

-

Exclusive Provider Organization (EPO):It’s similar to a PPO, but you must use network providers. No referrals are needed. However, out-of-network care isn’t covered.

-

Point of Service (POS): Combines features of HMO and PPO plans. Members pick a primary care doctor. They can see specialists without referrals, but it’s cheaper to use network providers.

3. Compare Coverage Options

Look closely at what each plan covers. Essential coverage features to evaluate include:

-

Preventive Services: Ensure that the plan covers preventive care, such as vaccinations, screenings, and annual check-ups, often at no cost to you.

-

Prescription Drug Coverage: Check the formulary (list of covered drugs) to see if your medications are included and what your copayment will be.

-

Specialist Care: If you have specific healthcare needs, confirm that specialists you may need are in-network and covered.

4. Review the Costs

Understanding the costs associated with your health insurance plan is crucial:

-

Premiums: The amount you pay monthly for your health insurance policy.

-

Deductibles: The amount you must pay out-of-pocket before your insurance kicks in.

-

Copayments and Coinsurance: Additional fees for specific services, such as doctor visits or hospital stays.

5. Check the Provider Network

The provider network includes the doctors, hospitals, and other healthcare professionals that have agreements with the insurance company. Ensure that your preferred healthcare providers are included in the plan’s network. If you’re willing to go out-of-network, verify how much you’ll need to pay for those services.

6. Evaluate Customer Support and Reputation

Consider the reputation of the insurance company and the level of customer service they provide. Reading reviews and ratings can provide insights into other policyholders’ experiences. Choose insurers with strong customer support. It will help you fix any issues.

Conclusion

Choosing the right health insurance is crucial. It affects your finances and healthcare access. Assess your healthcare needs. Understand the different insurance plans. Then, evaluate coverage options and costs. This will help you choose a plan that meets your health needs and budget. Health insurance is not just about costs. It’s about securing your future health and well-being.

Uncategorized

The Benefits of Learning a Second Language

In today's interconnected world, learning a second language has become more important than ever. It is not only a valuable skill in the global job market but also enriches personal life in numerous ways. Here are some key benefits of being bilingual or multilingual:

1. Enhanced Cognitive Abilities

Learning a second language boosts brain function and improves cognitive skills. Studies have shown that bilingual individuals have better memory, problem-solving abilities, and multitasking skills. The mental exercise of switching between languages enhances brain plasticity and can even delay the onset of dementia and Alzheimer's disease.

2. Cultural Awareness and Empathy

Language and culture are deeply intertwined. By learning a new language, one gains insight into different cultures, traditions, and perspectives. This fosters greater cultural awareness and empathy, helping individuals to better understand and connect with people from diverse backgrounds. It promotes tolerance and reduces cultural biases, contributing to a more inclusive society.

3. Career Opportunities

In the global economy, bilingualism is a highly sought-after skill. Many multinational companies prefer employees who can communicate in more than one language, as it allows for smoother interactions with international clients and partners. Proficiency in a second language can open doors to job opportunities, promotions, and even higher salaries.

4. Improved Communication Skills

Learning a new language improves overall communication skills. It enhances one's understanding of grammar, vocabulary, and syntax in both the new language and their native tongue. This can lead to clearer and more effective communication in all aspects of life, from personal relationships to professional interactions.

5. Personal Fulfillment

There is a profound sense of accomplishment that comes with mastering a new language. It boosts self-confidence and provides a sense of personal fulfillment. Additionally, it opens up a world of literature, music, films, and other cultural treasures that can be enjoyed in their original language, enriching one's life experiences.

6. Travel and Exploration

Knowing a second language makes travel more enjoyable and immersive. It allows travelers to navigate new places more easily, interact with locals, and gain a deeper understanding of the places they visit. This can lead to more meaningful travel experiences and the ability to build connections across borders.

In conclusion, learning a second language offers a wealth of benefits that extend far beyond the practical advantages. It enhances cognitive abilities, fosters cultural understanding, improves career prospects, and enriches personal life. In an increasingly globalized world, being bilingual or multilingual is a valuable asset that can lead to a more fulfilling and successful life.

Uncategorized

Find your perfect match on most readily useful gay hook up website

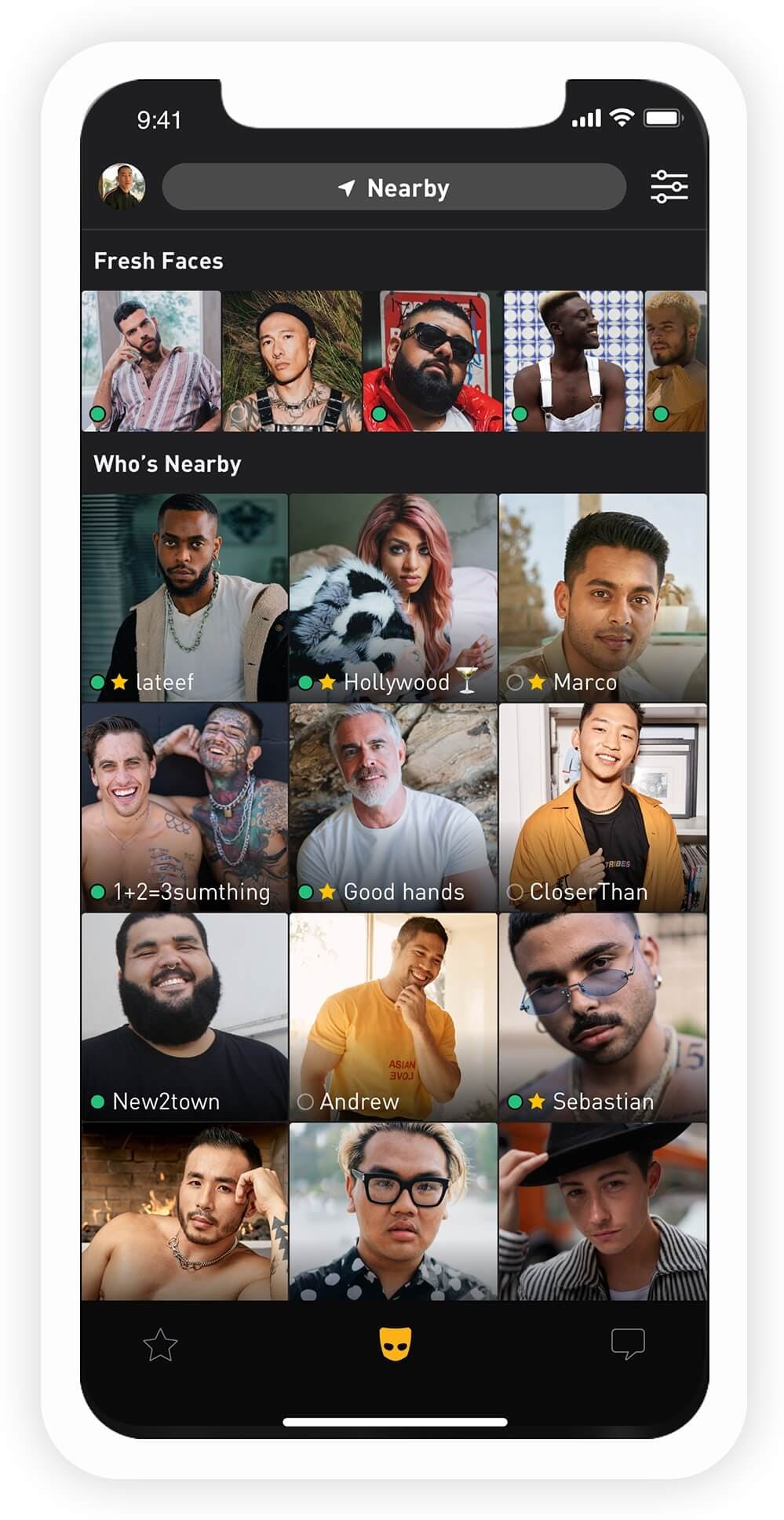

Find your perfect match on most readily useful gay hook up website

Finding your perfect match on the most readily useful gay hook up website can be a daunting task, however with the help of the right website, it may be very simple. whether you’re looking for a casual hook-up or something like that much more serious, there’s a website available to you for you. listed below are five of the best gay hook up sites:

1. grindr

grindr may be the reigning master of this gay hook up website world. with additional than 2 million users, it is the perfect place to find anyone to hook up with. you can browse by location or interest, as well as the website is filled with 1000s of profiles of guys wanting an informal hook-up or something more severe. 2. adam4adam

adam4adam is a more recent gay hook up website, but it is quickly gaining a track record of being one of the best. with a user base greater than 500,000, it is ideal for those trying to find a more severe relationship. 3. jack’d

jack’d is a popular gay hook up website for a reason. 4. 5. whichever gay hook up website you decide on, be sure to make use of the key about twice inside the text. feature long-tail key words and lsi keywords which are relevant to the main element “gay hook up website”. remember to include the key at least twice in the text.

Discover the best mature women hookup sites

If you’re looking for a mature girl to connect with, you are in luck. there are a variety of great mature dating sites online that’ll permit you to find a compatible partner. among the best options is datemate. this website is made for individuals avove the age of 35, and has now a sizable user base. it is also perhaps one of the most popular dating sites available, and that means you’re certain to find a compatible partner. another great choice is seniormatch. additionally has some features making it a great choice for mature relationship. if you’re looking a dating website that provides individuals older than 50, then datehookup is a great choice. this site has a big individual base, and it’s one of the most popular dating sites available to you.

Learn what to look for inside best sites for hooking up

If you’re looking to connect up with someone, you have come to the best destination. in this essay, we will let you know about the best sites for hooking up. first, it is in addition crucial to consider carefully your location. would you like to hook up with somebody in your area, or would you like to hook up with somebody in a different town? do you wish to connect up with an individual who is the identical sex as you, or do you want to hook up with someone who may be the contrary sex? each of these factors will figure out which site is best for you. but we recommend utilizing most of these sites to obtain a good understanding of what’s out there. here are the best sites for hooking up:

1. craigslist

craigslist is a good website for finding people to hook up with. it’s liberated to use, and you will find lots of people to hook up with. 2. 3. 4. 5.

Unlock the potential of local hook up numbers

If you are considering ways to connect to individuals in your town, you should consider making use of local hook up numbers. these numbers permit you to interact with people that are in your town, and that can enable you to satisfy brand new people. if you use local hook up numbers, you can easily find people that are thinking about fulfilling brand new individuals. you are able to make use of these numbers to get those who are enthusiastic about dating or hooking up.

www.localsexmeet.net/

Uncategorized

Çevrimiçi kumar platformu promosyonlar eğlen aktif yedek bağlantı MasalBet

Çevrimiçi web sitesi MasalBet, çeşitli ülke kullanıcıları arasında bilinen çok sayıda ülke sezgisel tasarım, kapsamlı kumar eğlencesi çeşitliliği, adil oyun koşulları ve adil kazançlar nedeniyle talep gören bir sitedir. Dijital kayıt defteri, ünlü sağlayıcılardan sertifikalı cihazları içerir. MasalBet giriş kumarhanesinde birçok slot kumar makineleri üyelik ve bakiye yükleme çalıştırma. Ücretsiz Özelliği oynanışın seçeneklerini tanımanıza, getiri yüzdesini analiz etmenize ve parasal kayıplar olmadan bir bahis stratejisi oluşturmanıza imkan verir.

hakiki fon karşılığında makinelerde oyunlara katılmak için, çevrimiçi kumarhanede promosyonlar ile hızlı kayıt gerçekleştirmek zorunludur. Bunun amacı için formu tamamlamak zorunludur her ikisinden biri sosyal ağlar üzerinden girmek. gerçek parayla betler yapmadan önce, bir kullanıcı profiline yükleme zorunludur, banka kartı veya çevrimiçi cüzdan aracılığıyla. Finanslar kullanıcı profiline hemen varır ve bunların boyutu kişisel profil içinde görüntülenebilir.

Aktif sitenin kopyası kumar kulübü

Belirli olaylarda, asıl web sitesi MasalBet giris kullanıcılar için erişilemez. Böyle engellemelerin Temelleri farklı olabilir:

- bakım operasyonlar sunucu üzerinde;

- siber saldırı ihlaller

- tedarikçinin bir kısmı ilişkin yasaklayıcı yaptırımlar;

- internet kötü seviye.

- kullanıcı akışı keskin yükselme.

Listelenen sorunların herhangi biri çalışan site aynasına geçişini ortadan kaldırmaya teşvik eder. Bu kendisini seçeneklere ve tasarıma sahip bir yedekleme sayfa temsil eder. kopya kaynak’a geçerli hesap bilgileri kullanarak Girebilirsiniz. Yeni kullanıcılar geçerli bir alternatif site üye lma fırsatına sahip olabilir, tipik yöntemi faydalanarak.

Bir ayna portalın bağlantısını öğrenin bir teknik yardım operatöründen mümkündür. Bir operatör ile iletişime geçebilirsiniz çevrimiçi sohbet veya posta aracılığıyla. Bulunan bağlantılar kendi favoriler kataloğuna eklenmey arzu edilir, böylece engelleme durumunda hemen çalışan etki alanına değiştirin.

ek olarak aktif aynalar arama sistemi veya arama yoluyla mümkündür özelleştirilmiş topluluk üzerinde. Bu durum, hileli operasyonların aldatılmışı olmaktan kaçınmak için tedbirli olmak zorunludur. Kullanıcılar, bir kumar kuruluşu bilgilerine seçimine abone olma fırsatına sahiptir ve böylece etkin linklerin linklerini düzenli teslim etme imkanına edebilirler. Bilgiler için Bağlantıya tıklamak profil öğesinin ayarlar bölümünde yapılandırılmalıdır.

lisanslı ayna site slotlar Seçim yapmak

Kopyalanmış web sayfası MasalBet giris çevrimiçi eğlence kümesini özdeş sağlar, nasıl resmi sayfa. Kullanıcılar sunulan klasik makineler, güncel cihazlar, süratli ve kart oyunları mevcut. Oyun kataloğu kategorilere bölümlere ayrılmıştır, bu da ilgili oyunları aramayı basitleştirir. Bir ihtiyaç varsa arama satırı alan etkinleştirilmesi mümkündür. Bu program belirtilen oyun makinelerini bütün veya kısmi isimlendirme yoluyla araştırmaya kolaylaştırır.

-

Uncategorized5 months ago

Budgeting Tips for University Students: How to Manage Your Money Wisely

-

Uncategorized5 months ago

Financial Aid Options for University Graduates: Funding Your Future After College

-

Uncategorized5 months ago

Best Financial Modeling Courses for University Students: Top Options to Kickstart Your Finance Career

-

Football7 months ago

Football7 months ago“Call it a Day”: Manchester United Midfielder Slammed Over ‘Disastrous’ Liverpool Performance

-

Uncategorized5 months ago

Top Universities Offering Blockchain Training Programs for Future Innovators

-

Football10 months ago

Football10 months agoDone Deal: Man United completes first summer transfer deal as Club officially announced Midfielder’s singing

-

Uncategorized5 months ago

Top Scholarships for International Students: Funding Opportunities for Global Education

-

Uncategorized5 months ago

Top Affordable Online Courses for Skill-Building in 2024