Uncategorized

Tips for Managing Student Debt: Your Guide to Financial Freedom

Introduction

For many students and grads, student debt is a heavy burden. It casts a long shadow over their financial futures. It’s essential to navigate student loans and manage student debt. This article will give tips for managing your student debt. They will help you take control of your finances and work towards a debt-free future.

Understanding Student Debt

What is Student Debt?

Student debt is money borrowed to pay for education. It usually comes from federal or private student loans. This debt can accumulate quickly, often leading to significant financial challenges for borrowers. College grads average thousands in debt. So, a solid plan to manage repayments is crucial.

The Financial Problem of Students

Student financial problems often come from high tuition and living costs. They must borrow to achieve their educational goals. Many students don’t know their loans will have long-term effects. This causes stress and uncertainty after graduation. Developing effective management strategies can help alleviate this burden.

Tips for Managing Student Debt

1. Create a Comprehensive Budget

One of the first steps in student debt managing is to establish a comprehensive budget. Include all sources of income, monthly expenses, and debt obligations. It will show your finances. It will help you find ways to cut back and pay off debt.

-

Track Your Expenses: Use budgeting apps or spreadsheets to track your spending. They will help you stay within your budget.

-

Prioritize Debt Payments: Each month, allocate a part of your budget to student loan payments. This will ensure timely repayments.

2. Explore Repayment Options

Familiarize yourself with the various repayment options available for your student loans. Depending on your financial situation, certain plans may be more beneficial:

-

Standard Repayment Plan: Fixed monthly payments over ten years.

-

Graduated Repayment Plan: Payments start lower and gradually increase every two years.

-

Income-Driven Repayment Plans: Payments based on your income, with the possibility of loan forgiveness after a set number of years.

By selecting the right repayment option, you can make managing your student debt more manageable.

3. Consider Refinancing

If you have good credit and a stable income, consider refinancing your student loans. Refinancing can lower your interest rate. This reduces your repayment costs. However, be cautious. Refinancing federal loans may cause you to lose benefits. These include income-driven repayment plans and loan forgiveness options.

4. Make Extra Payments When Possible

If your budget allows, try to make extra payments towards your student debt. Even small extra payments can cut the total interest on the loan. Focus on paying down higher-interest loans first to maximize your savings.

5. Stay Informed About Loan Forgiveness Programs

Some student loan forgiveness programs can help certain professionals, like teachers. Research them for potential relief. If eligible, these programs can help you. So, know their requirements and the application process.

6. Seek Financial Counseling

If you are overwhelmed by student debt, seek financial counseling. Many groups offer free or low-cost services. They help borrowers understand their options and create debt management plans.

7. Keep Open Communication with Lenders

If you anticipate difficulty making a payment, reach out to your loan servicer. Many lenders offer deferment, forbearance, or alternative repayment plans for borrowers experiencing financial hardship. Open communication can help you avoid missed payments. It will protect your credit score.

Conclusion

Managing student debt can be challenging, but with the right strategies in place, you can take control of your financial future. You can achieve financial stability by managing student loans. Create a budget, explore repayment options, and seek help when needed. You are not alone in this journey. Many resources can help you. They can support you in overcoming student debt and achieving a debt-free life.

Uncategorized

The Benefits of Learning a Second Language

In today's interconnected world, learning a second language has become more important than ever. It is not only a valuable skill in the global job market but also enriches personal life in numerous ways. Here are some key benefits of being bilingual or multilingual:

1. Enhanced Cognitive Abilities

Learning a second language boosts brain function and improves cognitive skills. Studies have shown that bilingual individuals have better memory, problem-solving abilities, and multitasking skills. The mental exercise of switching between languages enhances brain plasticity and can even delay the onset of dementia and Alzheimer's disease.

2. Cultural Awareness and Empathy

Language and culture are deeply intertwined. By learning a new language, one gains insight into different cultures, traditions, and perspectives. This fosters greater cultural awareness and empathy, helping individuals to better understand and connect with people from diverse backgrounds. It promotes tolerance and reduces cultural biases, contributing to a more inclusive society.

3. Career Opportunities

In the global economy, bilingualism is a highly sought-after skill. Many multinational companies prefer employees who can communicate in more than one language, as it allows for smoother interactions with international clients and partners. Proficiency in a second language can open doors to job opportunities, promotions, and even higher salaries.

4. Improved Communication Skills

Learning a new language improves overall communication skills. It enhances one's understanding of grammar, vocabulary, and syntax in both the new language and their native tongue. This can lead to clearer and more effective communication in all aspects of life, from personal relationships to professional interactions.

5. Personal Fulfillment

There is a profound sense of accomplishment that comes with mastering a new language. It boosts self-confidence and provides a sense of personal fulfillment. Additionally, it opens up a world of literature, music, films, and other cultural treasures that can be enjoyed in their original language, enriching one's life experiences.

6. Travel and Exploration

Knowing a second language makes travel more enjoyable and immersive. It allows travelers to navigate new places more easily, interact with locals, and gain a deeper understanding of the places they visit. This can lead to more meaningful travel experiences and the ability to build connections across borders.

In conclusion, learning a second language offers a wealth of benefits that extend far beyond the practical advantages. It enhances cognitive abilities, fosters cultural understanding, improves career prospects, and enriches personal life. In an increasingly globalized world, being bilingual or multilingual is a valuable asset that can lead to a more fulfilling and successful life.

Uncategorized

Find your perfect match on most readily useful gay hook up website

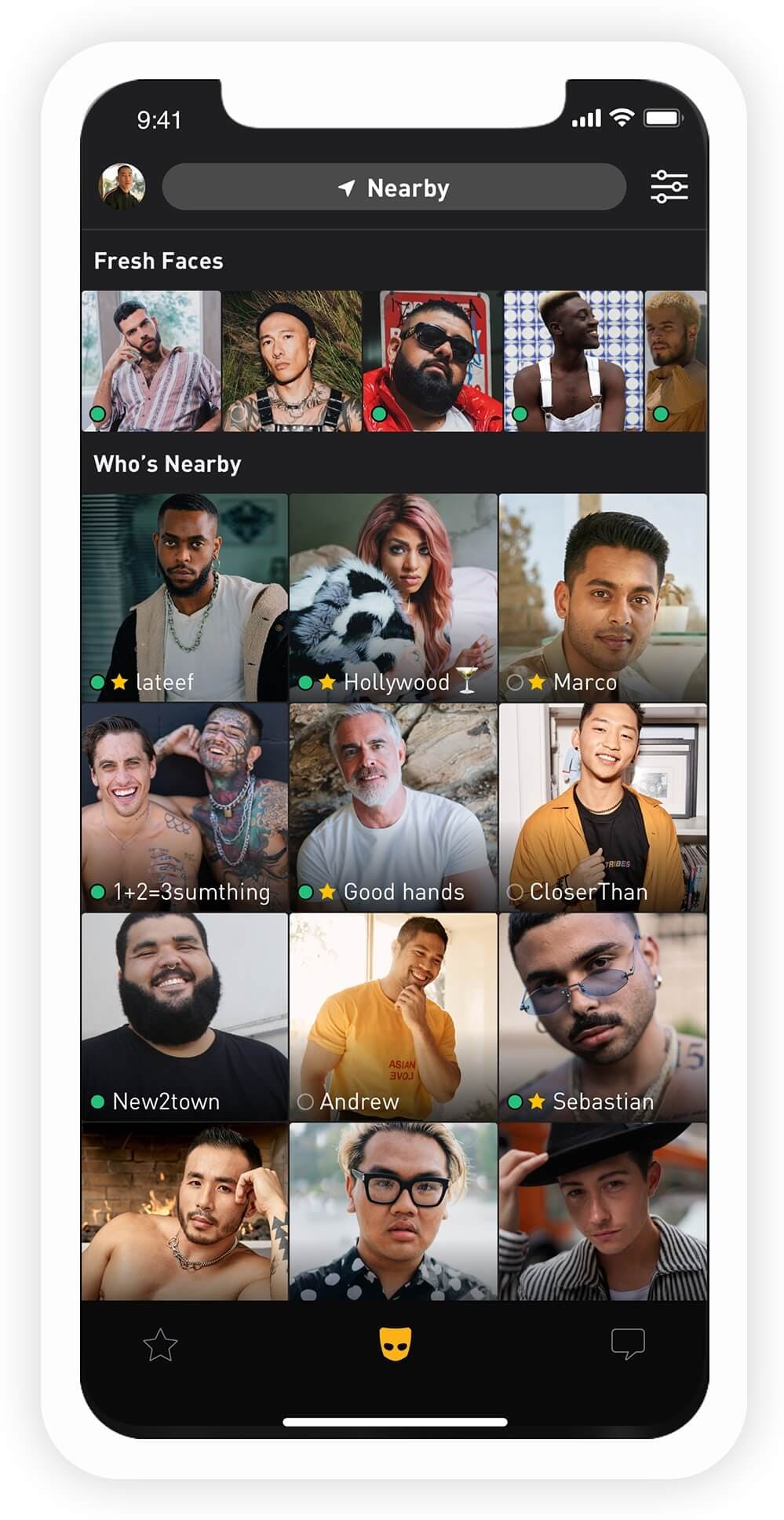

Find your perfect match on most readily useful gay hook up website

Finding your perfect match on the most readily useful gay hook up website can be a daunting task, however with the help of the right website, it may be very simple. whether you’re looking for a casual hook-up or something like that much more serious, there’s a website available to you for you. listed below are five of the best gay hook up sites:

1. grindr

grindr may be the reigning master of this gay hook up website world. with additional than 2 million users, it is the perfect place to find anyone to hook up with. you can browse by location or interest, as well as the website is filled with 1000s of profiles of guys wanting an informal hook-up or something more severe. 2. adam4adam

adam4adam is a more recent gay hook up website, but it is quickly gaining a track record of being one of the best. with a user base greater than 500,000, it is ideal for those trying to find a more severe relationship. 3. jack’d

jack’d is a popular gay hook up website for a reason. 4. 5. whichever gay hook up website you decide on, be sure to make use of the key about twice inside the text. feature long-tail key words and lsi keywords which are relevant to the main element “gay hook up website”. remember to include the key at least twice in the text.

Discover the best mature women hookup sites

If you’re looking for a mature girl to connect with, you are in luck. there are a variety of great mature dating sites online that’ll permit you to find a compatible partner. among the best options is datemate. this website is made for individuals avove the age of 35, and has now a sizable user base. it is also perhaps one of the most popular dating sites available, and that means you’re certain to find a compatible partner. another great choice is seniormatch. additionally has some features making it a great choice for mature relationship. if you’re looking a dating website that provides individuals older than 50, then datehookup is a great choice. this site has a big individual base, and it’s one of the most popular dating sites available to you.

Learn what to look for inside best sites for hooking up

If you’re looking to connect up with someone, you have come to the best destination. in this essay, we will let you know about the best sites for hooking up. first, it is in addition crucial to consider carefully your location. would you like to hook up with somebody in your area, or would you like to hook up with somebody in a different town? do you wish to connect up with an individual who is the identical sex as you, or do you want to hook up with someone who may be the contrary sex? each of these factors will figure out which site is best for you. but we recommend utilizing most of these sites to obtain a good understanding of what’s out there. here are the best sites for hooking up:

1. craigslist

craigslist is a good website for finding people to hook up with. it’s liberated to use, and you will find lots of people to hook up with. 2. 3. 4. 5.

Unlock the potential of local hook up numbers

If you are considering ways to connect to individuals in your town, you should consider making use of local hook up numbers. these numbers permit you to interact with people that are in your town, and that can enable you to satisfy brand new people. if you use local hook up numbers, you can easily find people that are thinking about fulfilling brand new individuals. you are able to make use of these numbers to get those who are enthusiastic about dating or hooking up.

www.localsexmeet.net/

Uncategorized

online kumar kuruluşu ödüller oyunları yönet güncellenmiş alternatif site Masal Bet güncel giriş

Sanal platform Masal Bet güncel giriş, birçok bölge oyuncuları arasında talep gören birçok bölge basit tasarım, geniş kumar oyunları spektrumu, şeffaf kuralları ve adil ödemeler nedeniyle popüler bir sitedir. Sanal liste, en iyi yaratıcılardan lisanslı slotları sunar. Masal Bet giriş kumarhanesinde çok sayıda kumar oyunu slot makinesi kayıt ve para yatırma açma. Demo modu oynanışın seçeneklerini bilmenize, ödeme seviyesini değerlendirmenize ve finansal riskler olmadan bir bahis taktikleri oluşturmanıza izin verir.

Gerçek para karşılığında slotlarda oyunlara katılmak için, internet kumarhanesinde bonuslar ile hızlı kayıt sürecini gerçekleştirmek zorunludur. Bunun amacı için formu veri girmek gereklidir veya giriş yapmak için sosyal ağları kullanmak. paralı bahisler uygulamadan daha önce, bir oyuncu bakiyesine yatırma yapması gerekir, sanal kart veya dijital cüzdan kullanarak. Fonlar müşteri hesabına anında gelir ve bunların boyutu kişisel profil içinde kontrol edilebilir.

Çalışıyor ayna kumarhane

Belirli durumlarda, ana kaynak Masal Bet ziyaretçiler için engellenir. Benzer kısıtlamaların Motifleri türlü olabilir:

- teknik prosedürler sunucu platformu üzerinde;

- kırma siber saldırılar

- işletmeci bir kısmı ilişkin kısıtlayıcı eylemler;

- ağ düşük kalite.

- aktivite ani büyüme.

belirtilen zorlukların herhangi biri aktif alternatif adrese geçişini ortadan kaldırmaya kolaylaştırır. Bu benzerini kriterlere ve tasarıma sahip bir yedek sayfa gösterir. alternatif sit portal’a önceki kullanıcı adı ve parola kullanarak Girebilirsiniz. Taze oyuncular aktif bir ayna kayıt olma fırsatına sahip olabilir, olağan algoritmayı kullanarak.

Bir alternatif site sitenin URL’sini keşfedin bir teknik destek uzmanından mümkündür. yardım ile iletişime geçebilirsiniz gerçek zamanlı sohbet veya email üzerinden. Bulunan linkler bireysel adresler numaralandırmasına eklenmey önerilir, böylece erişim kısıtlamaları durumunda hızlıca işleyen etki alanına taşıyın.

dahası çalışan alternatif bağlantılar arama motoru her ikisi arama yoluyla uygundur tematik topluluk üzerinde. Bu olayda, yalancı eylemlerin mağduru olmaktan kaçınmak için uyanık olmak gereklidir. Üyeler, bir kumar platformunun güncellemelerine posta listesine abone olma imkanına sahiptir ve böylece çalışan aynaların bağlantılarını sürekli alma fırsatına sahip olabilir. Güncellemeler için Abone olmak hesap öğesinin ayarlar bölümünde etkinleştirilmelidir.

onaylı kopya site slot makineleri Seçim

Çoğaltılmış sayfa Masal Bet internet oyunları aralığı özdeş içerir, ne resmi site. Üyeler mevcut retro slotlar, en yeni makineler, anında ve klasik oyunlar sunulan. Kumar listesi bölümlere bölümlere ayrılmıştır, bu da uygun başlıkları seçmeyi basitleştirir. bir talep varsa arama dizesi sütun uygulanması izinlidir. Bu sistem belirtildiği gibi slotları tam veya tamamlanmamış adlandırma yoluyla bulmaya teşvik eder.

-

Uncategorized5 months ago

Budgeting Tips for University Students: How to Manage Your Money Wisely

-

Uncategorized5 months ago

Financial Aid Options for University Graduates: Funding Your Future After College

-

Uncategorized5 months ago

Best Financial Modeling Courses for University Students: Top Options to Kickstart Your Finance Career

-

Football7 months ago

Football7 months ago“Call it a Day”: Manchester United Midfielder Slammed Over ‘Disastrous’ Liverpool Performance

-

Uncategorized5 months ago

Top Universities Offering Blockchain Training Programs for Future Innovators

-

Football10 months ago

Football10 months agoDone Deal: Man United completes first summer transfer deal as Club officially announced Midfielder’s singing

-

Uncategorized5 months ago

Top Scholarships for International Students: Funding Opportunities for Global Education

-

Uncategorized5 months ago

Top Affordable Online Courses for Skill-Building in 2024